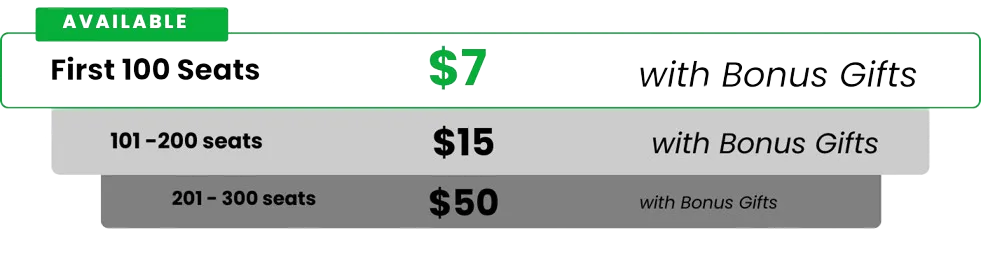

Last Chance: $7 One-Time To Join And NOW Copy My Live Trades Daily At 1-2 PM EST. Ending Shortly!

Imagine Yourself 3 Days From Now

Passing Prop Firm Evaluations Effortlessly

“Even if You've NEVER Successfully

Gotten Funded in Your Life Before...”

Imagine Yourself 3 Days From Now

Passing Prop Firm Evaluations...

“Even if You've NEVER Successfully

Gotten Funded in Your Life Before...”

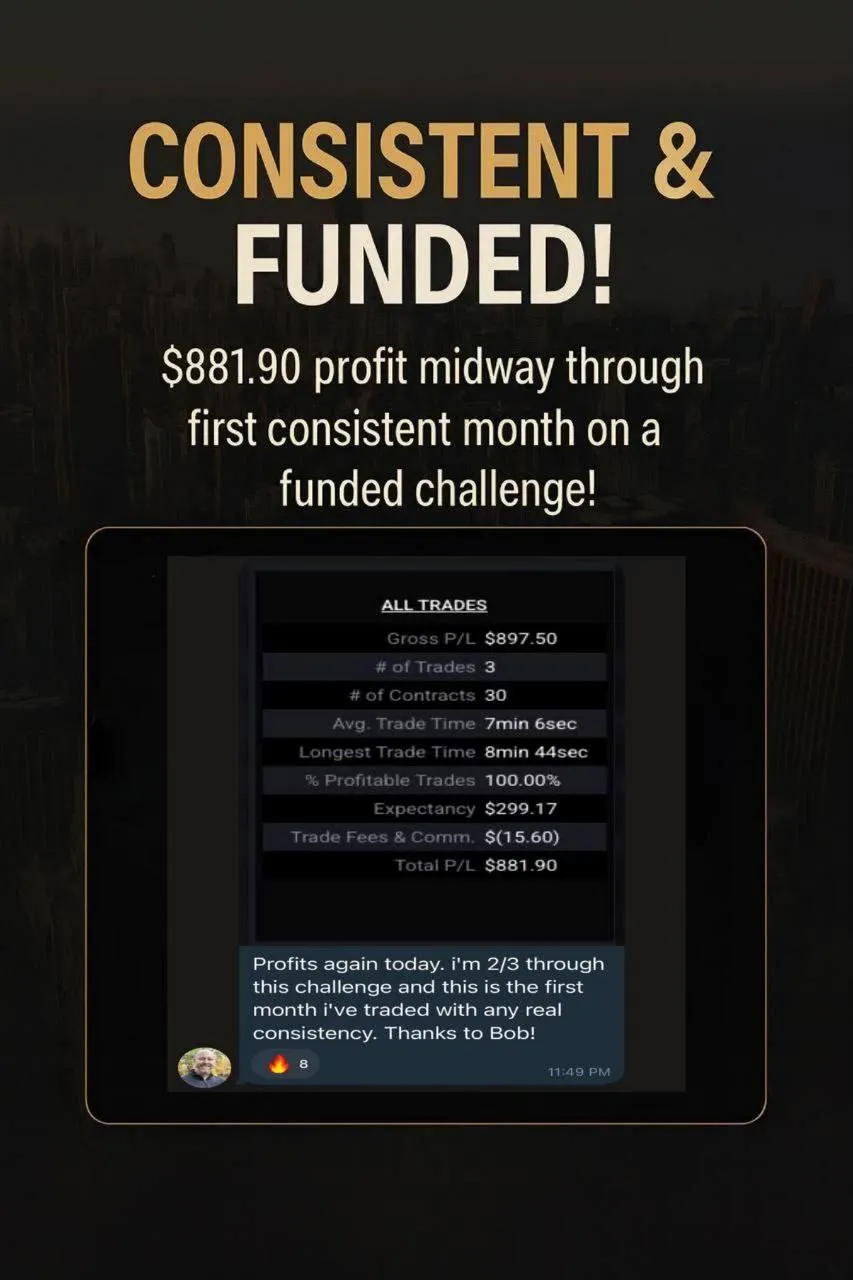

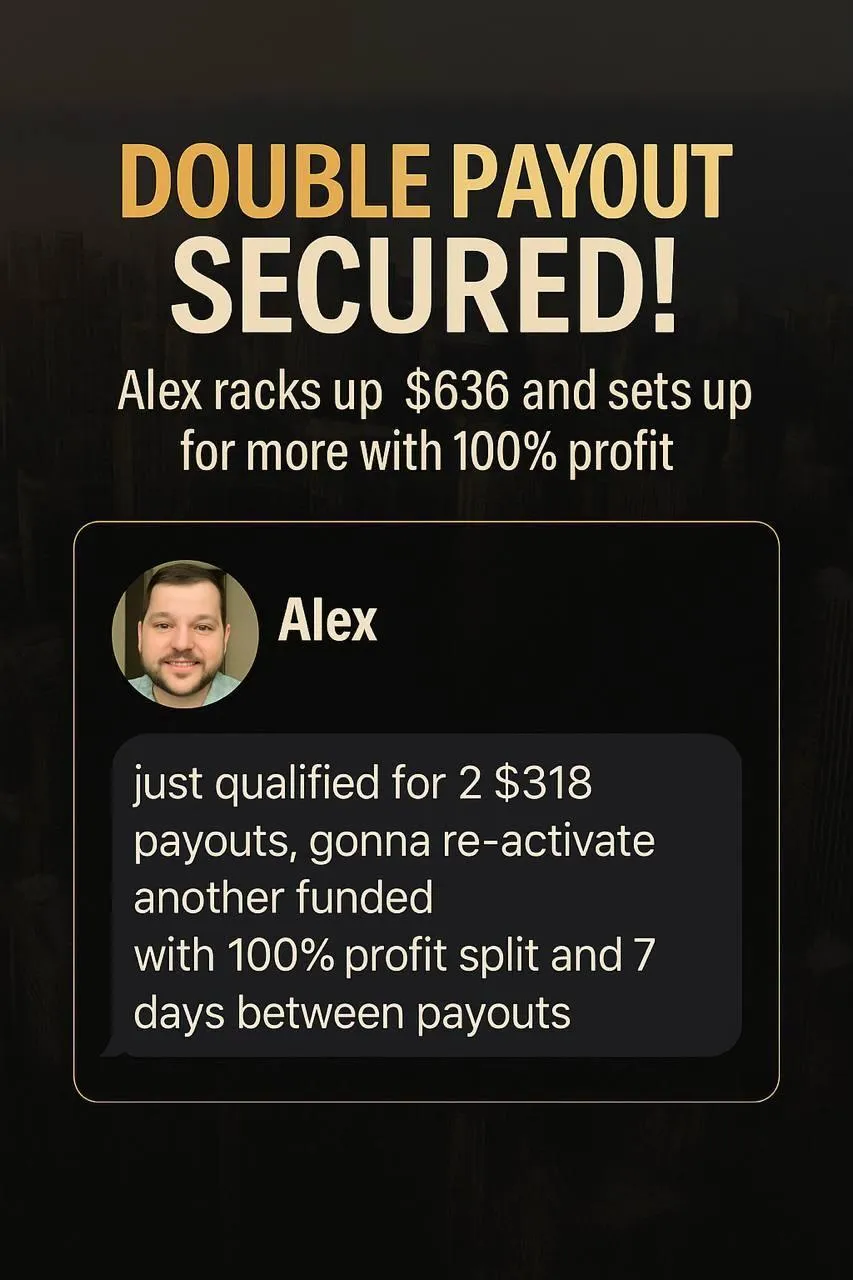

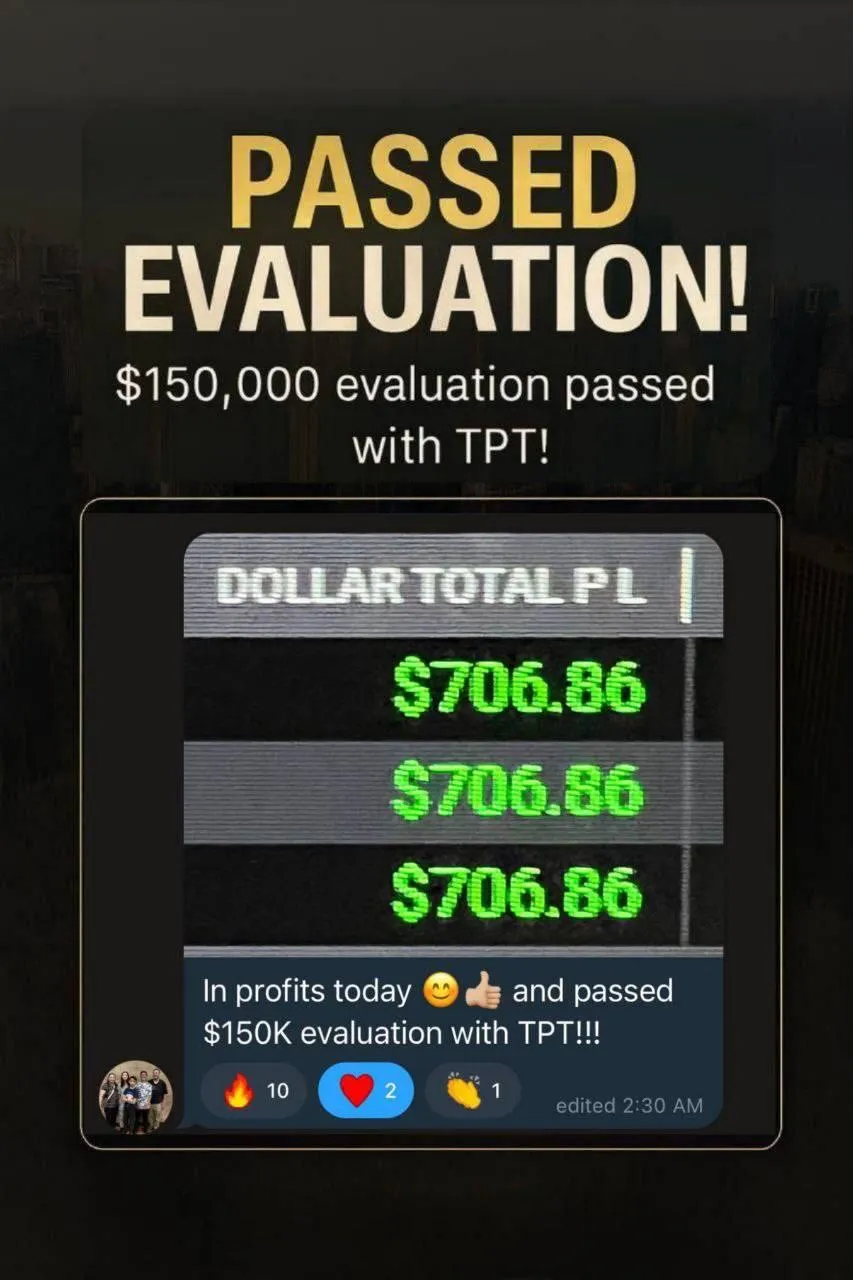

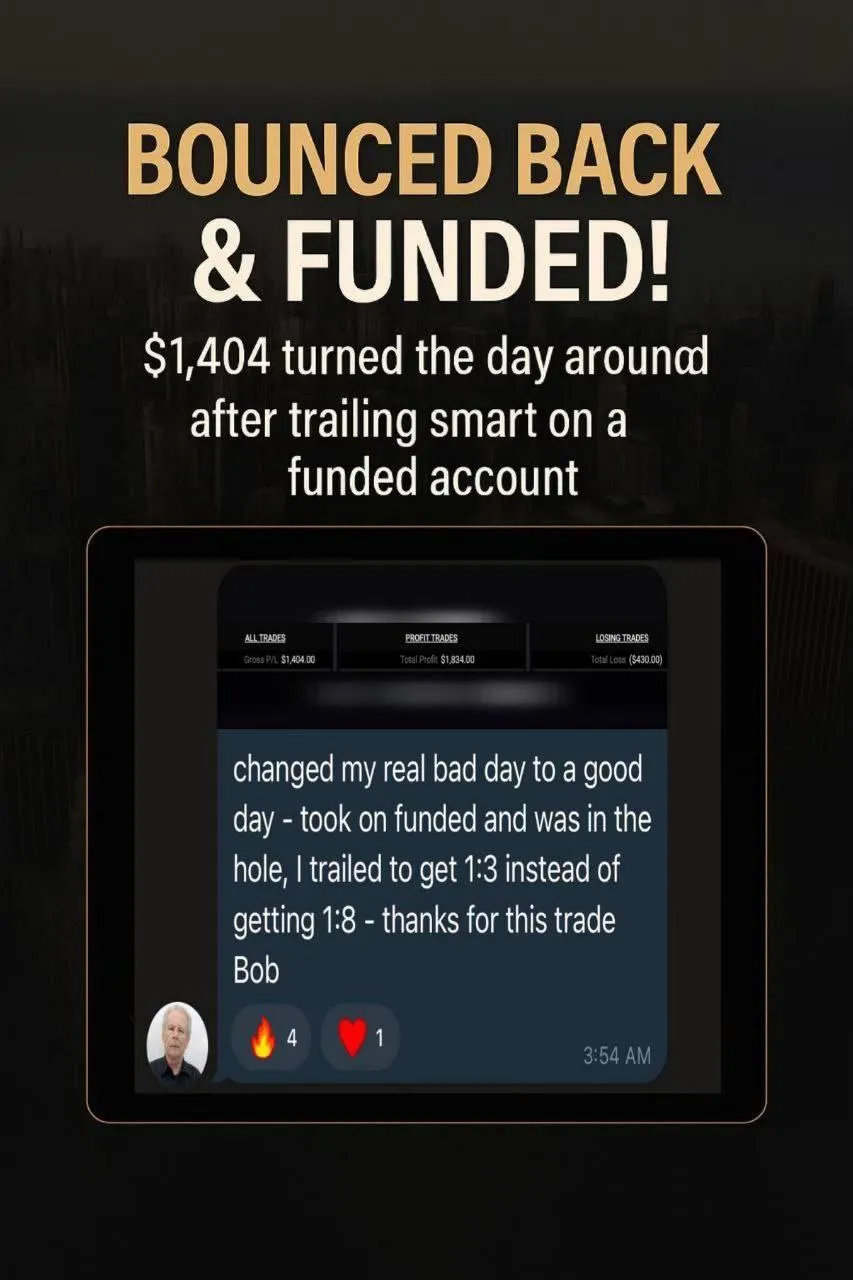

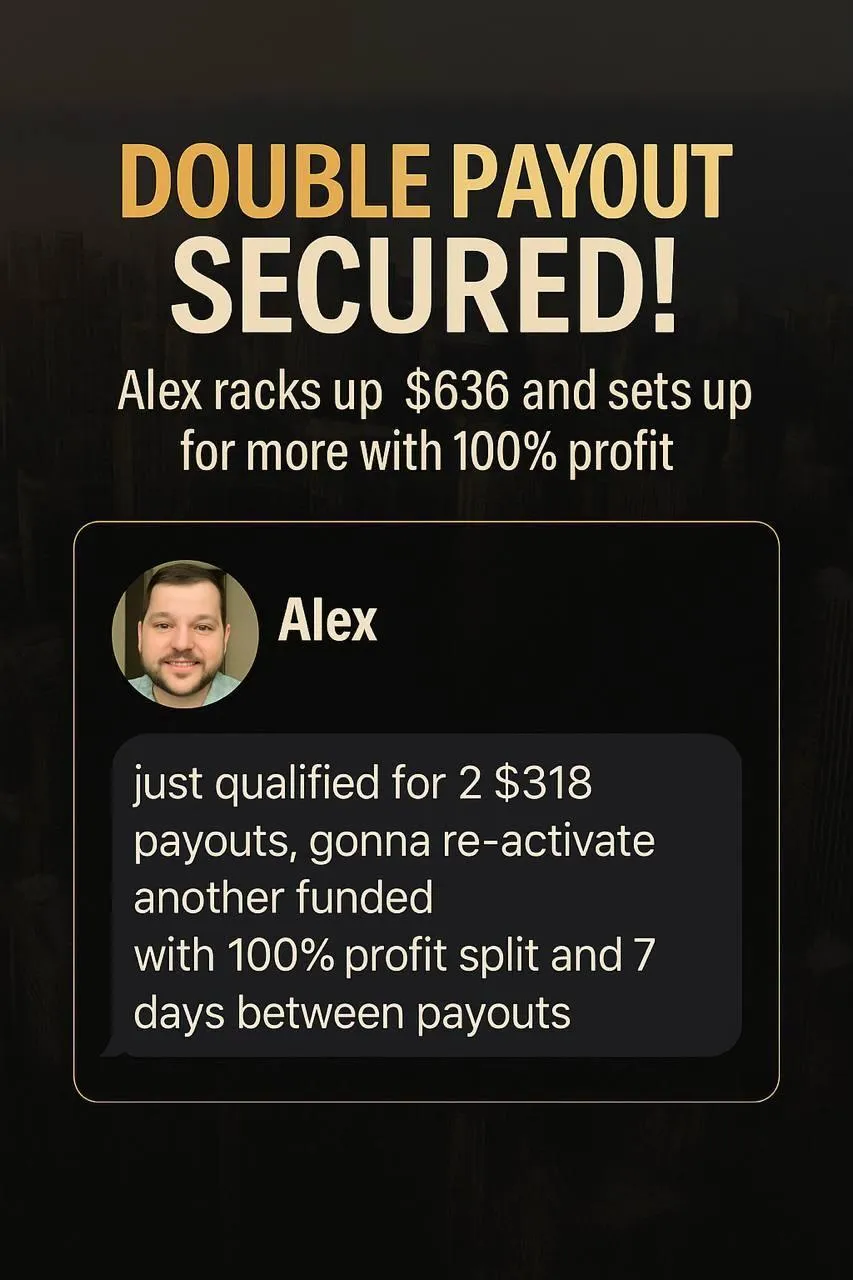

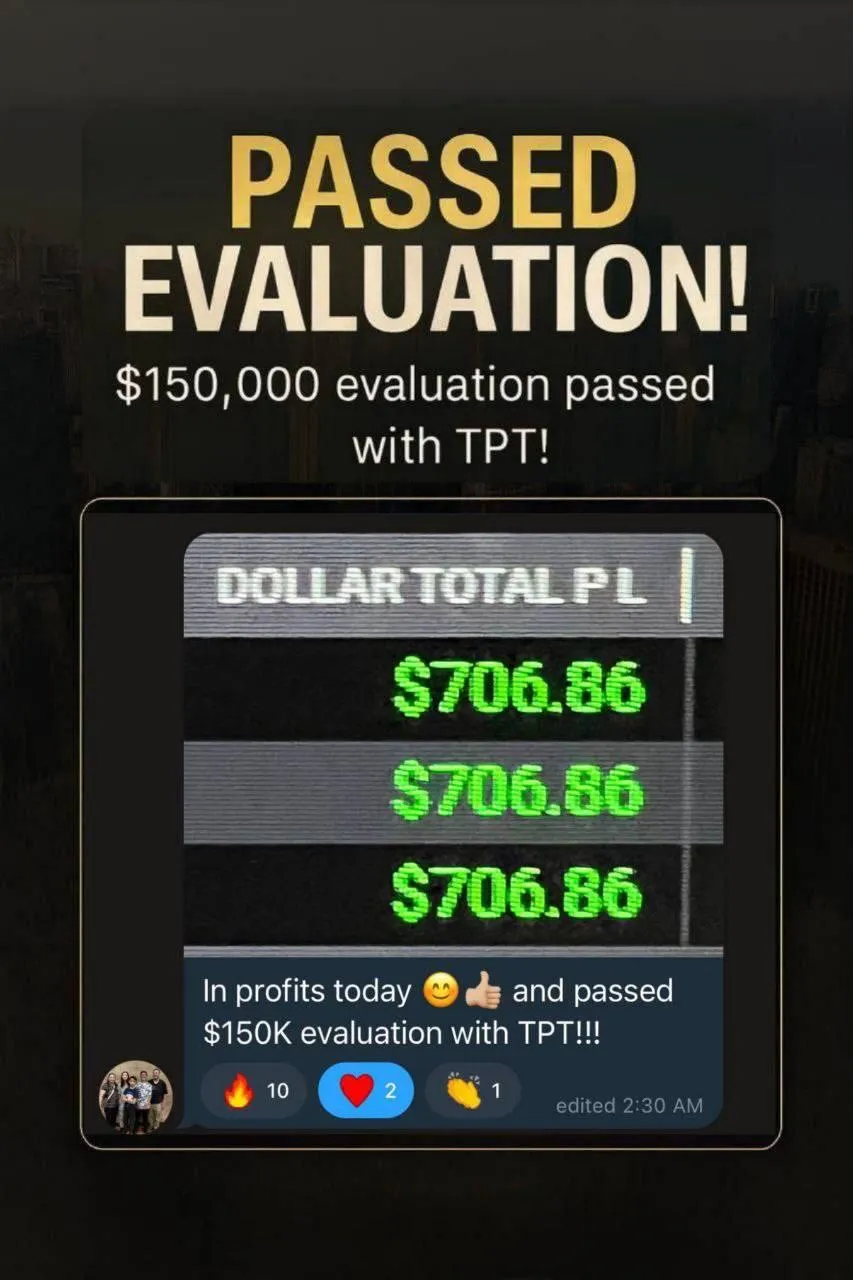

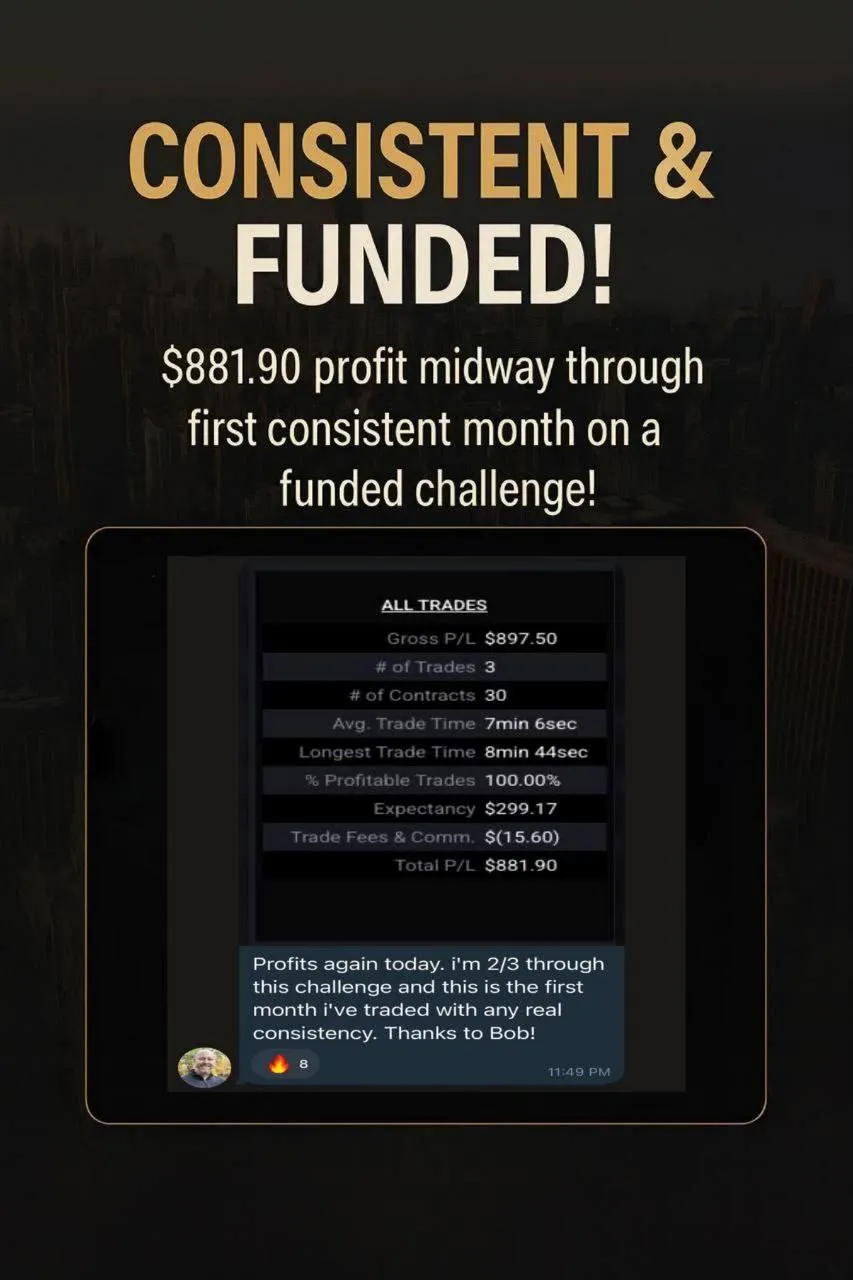

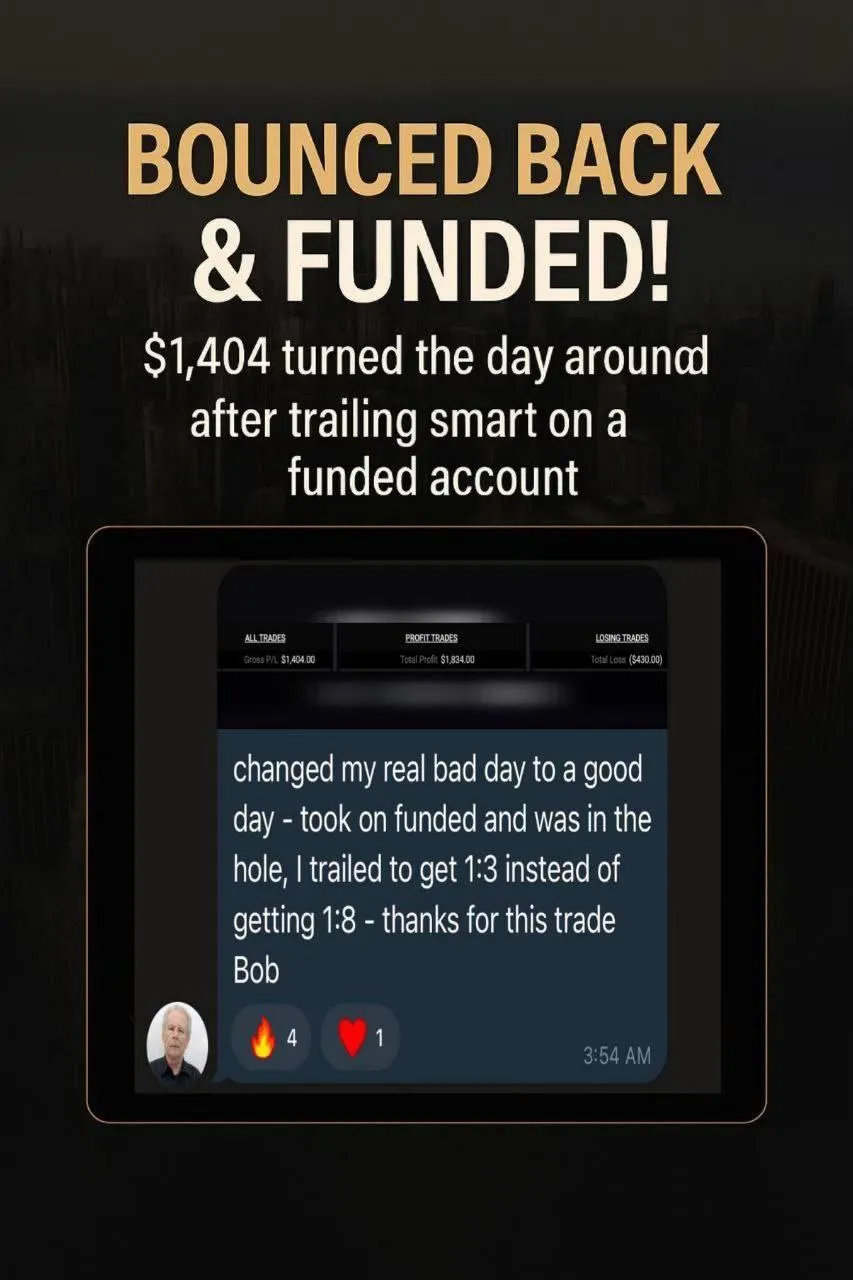

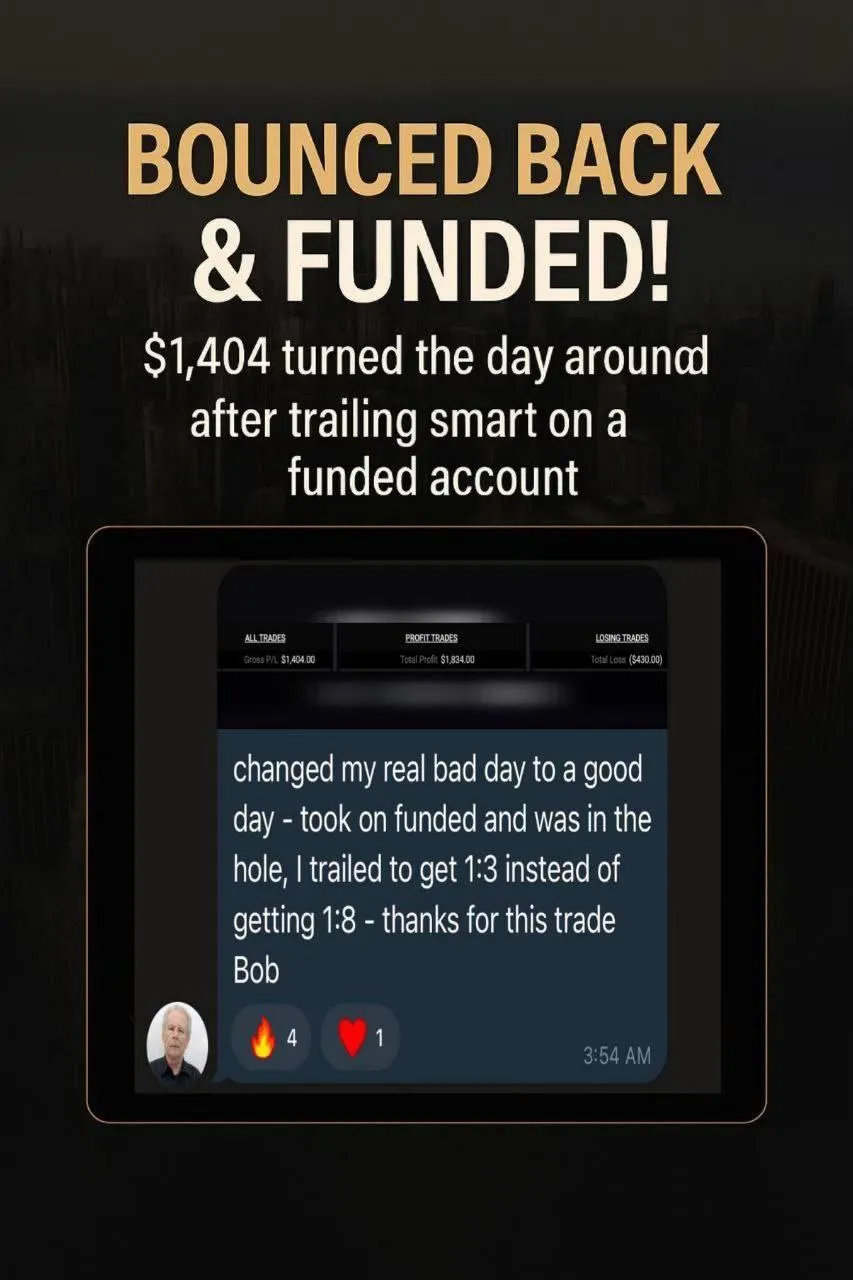

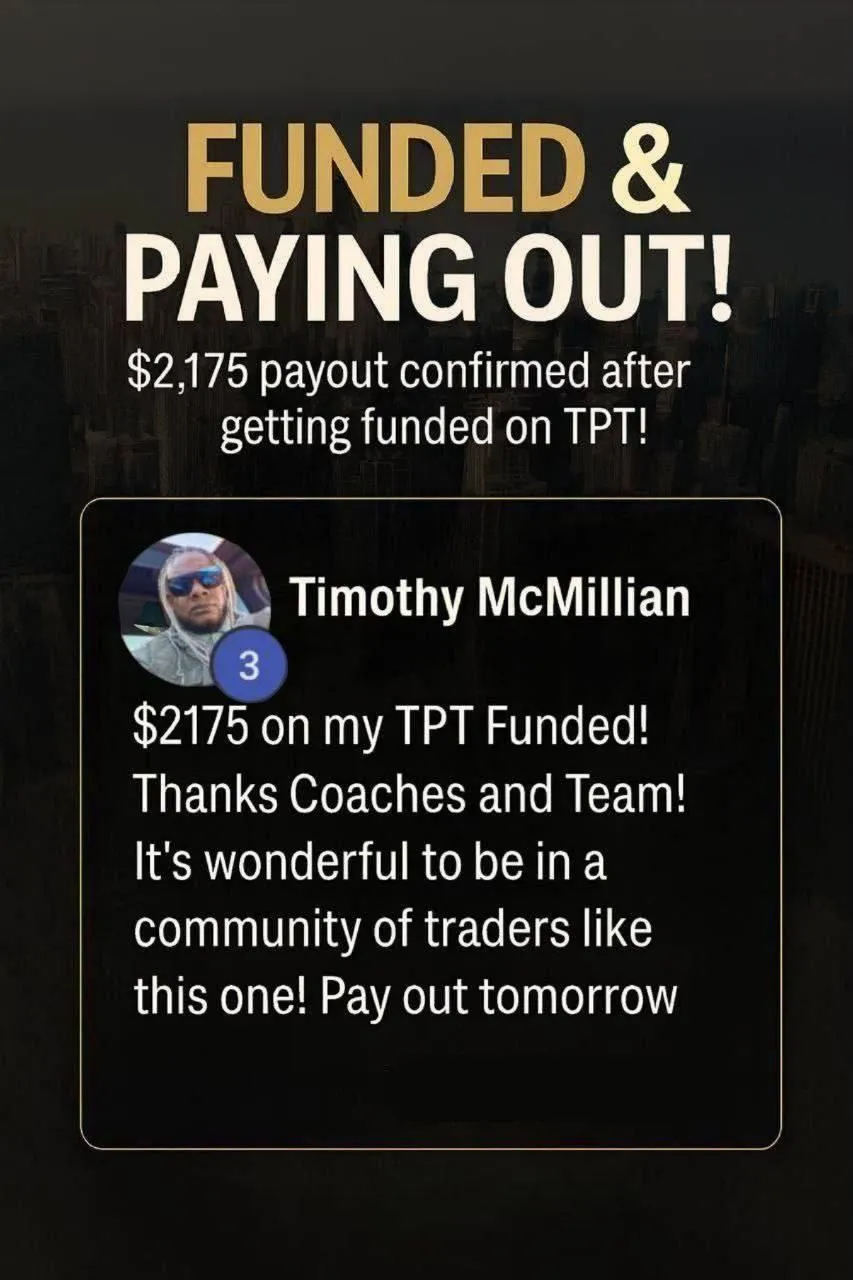

Student Spotlight: Recent Prop Firm Wins Using the Futures Made Easy System...

Student Spotlight: Recent Prop Firm Wins Using the Futures Made Easy System...

Discover how to Pass Your First Futures Prop Firm in 3 days or less without having to spend hours per day on the charts!

This training simplifies trading Prop Firms so you can get up and running quickly, even if you're newer to trading.

…And I'll Give You My Proven Step-By-Step Strategy That’ll Help You Trade Just 15-30 Minutes Per Day To Help You Start Taking Consistent Trades On Your Own!”

I Don't invest in stocks or crypto but raded Futures

Why Trade Futures Instead of Forex, Crypto, Options, or Stocks?!

No More Forex Spreads

Tired of high forex spreads and market manipulation? With futures, there’s zero spread, meaning you get in at the exact price you want, without any hidden costs.

More Stable Than Crypto

Unlike the highly volatile and unpredictable nature of cryptocurrency, futures have standardized contracts and a long history of trading, making price movements more predictable.

Lower Barrier to Entry vs. Options:

Trading options can require a hefty account size—sometimes over $25,000! With futures, you can start trading with as little as $100, and there are no PDT (Pattern Day Trader) restrictions. You don’t need to worry about delta, theta, or complex options strategies.

Unlike Stocks, You Don’t Need a Huge Account

With stocks, it’s easy to feel like you’re stuck on the sidelines without a big account balance. Futures let you control large positions with small margin requirements, so you can trade with greater flexibility.

Why Join the Futures Trading

Made Easy?

In this fast-paced training, I’ll guide you step-by-step, from learning the basics of futures to executing your very first trade—all in just 3 days or less. Here’s what you’ll get

In this fast-paced training, I’ll guide you step-by-step, from learning the basics of futures to staying consistently profitable with your prop firm accounts... all in just 3 days or less. Here’s what you’ll get...

Setup Your Trading Platform

(unlocked instantly)

Introduction to Futures: What futures are, how they work, and why they’re one of the best markets for traders.

Getting Your Account Set Up: How to open a demo account, futures prop firm where you can leverage other people's money, and/or fund your futures trading account with as little as $100. (I am not a financial advisor and I’m not telling you to use real money.)

Avoiding Beginner Pitfalls: Learn the most common mistakes new futures traders make and how to avoid them

Mastering the Entry for Prop Firms

(unlocked instantly)

Finding Key Zones to Trade From: Discover how to Identify the "right" zones quickly... that will get the you the best chance at having a successful trade!

Mastering the Entry: I'll show you how to take one of my favorite entries that happens on all time frames and all sessions that helps you pass prop firm accounts quickly!

Risk Management Simplified : I’ll break down how to manage your risk like a pro, even if you’ve never traded before. Without knowing how to risk properly... specifically for prop firms... you will NEVER stay consistent!

Trade Other Peoples Money

(unlocked instantly)

How to Setup and Trade Copy Up to 20 Prop Firm Accounts at Once: I'm going to show you how to start taking Prop Firm Evaluations that will allow you to leverage other peoples money without having the consequence of having to pay them back if you lose!

Trading Evaluations LIVE: I will show you how I made just over $7,500 on 10 brand new evaluations and how you can trade LIVE with me daily as I pass prop firm accounts right in front of your eyes!

Why Is This Perfect for You?

If You've Failed Prop Firm After Prop Firm...

This training is designed to take you from zero to passing your first prop firm and getting funded in just 3 days.

Ready To Become A Master at Prop Firm Trading With The Iron-Clad Confidence To Easily Start Passing and "Keeping" Prop Firm Accounts in 3 Days or Less?

DON'T WAIT! SIGN UP AND START PASSING PROP FIRM EVALUATIONS!

Discover how to Pass Your First Futures Prop Firm in 3 days or less without having to spend hours per day on the charts!

This training simplifies trading Prop Firms so you can get up and running quickly, even if you're newer to trading.

…And I'll Give You My Proven Step-By-Step Strategy That’ll Help You Trade Just 15-30 Minutes Per Day To Help You Start Taking Consistent Trades On Your Own!”

Why Trade Futures Instead of Forex, Crypto, Options, or Stocks?!

No More Forex Spreads

Tired of high forex spreads and market manipulation? With futures, there’s zero spread, meaning you get in at the exact price you want, without any hidden costs.

More Stable Than Crypto

Unlike the highly volatile and unpredictable nature of cryptocurrency, futures have standardized contracts and a long history of trading, making price movements more predictable.

Lower Barrier to Entry vs. Options:

Trading options can require a hefty account size—sometimes over $25,000! With futures, you can start trading with as little as $100, and there are no PDT (Pattern Day Trader) restrictions. You don’t need to worry about delta, theta, or complex options strategies.

Unlike Stocks, You Don’t Need a Huge Account

With stocks, it’s easy to feel like you’re stuck on the sidelines without a big account balance. Futures let you control large positions with small margin requirements, so you can trade with greater flexibility.

Why Join the Futures Trading

Made Easy?

In this fast-paced training, I’ll guide you step-by-step, from learning the basics of futures to staying consistently profitable with your prop firm accounts... all in just 3 days or less. Here’s what you’ll get...

Setup Your Trading Platform

(unlocked instantly)

Introduction to Futures: What futures are, how they work, and why they’re one of the best markets for traders.

Getting Your Account Set Up: How to open a demo account, futures prop firm where you can leverage other people's money, and/or fund your futures trading account with as little as $100. (I am not a financial advisor and I’m not telling you to use real money.)

Avoiding Beginner Pitfalls: Learn the most common mistakes new futures traders make and how to avoid them

Mastering the Entry for Prop Firms

(unlocked instantly)

Finding Key Zones to Trade From: Discover how to Identify the "right" zones quickly... that will get the you the best chance at having a successful trade!

Mastering the Entry: I'll show you how to take one of my favorite entries that happens on all time frames and all sessions that helps you pass prop firm accounts quickly!

Risk Management Simplified : I’ll break down how to manage your risk like a pro, even if you’ve never traded before. Without knowing how to risk properly... specifically for prop firms... you will NEVER stay consistent!

Trade Other Peoples Money

(unlocked instantly)

How to Setup and Trade Copy Up to 20 Prop Firm Accounts at Once: I'm going to show you how to start taking Prop Firm Evaluations that will allow you to leverage other peoples money without having the consequence of having to pay them back if you lose!

Trading Evaluations LIVE: I will show you how I made just over $7,500 on 10 brand new evaluations and how you can trade LIVE with me daily as I pass prop firm accounts right in front of your eyes!

Why Is This Perfect for You?

If You've Failed Prop Firm After Prop Firm...

This training is designed to take you from zero to passing your first prop firm and start getting funded in just 3 days.

Ready To Become A Master at Prop Firm Trading With The Iron-Clad Confidence To Easily Start Passing and "Keeping" Prop Firm Accounts in 3 Days or Less?

DON'T WAIT! SIGN UP AND START TRADING PASSING PROP FIRM EVALUATIONS